postmates tax form online

Make estimated payments throughout the year to avoid a penalty. You pay 153 SE tax on 9235 of your Net Profit greater than 400.

Complete Guide To Postmates Tipping Etiquette Maid Sailors

I dont even do this shit anymore.

. Postmates Tax Form 1099. File your taxes at your own pace. Youll find your delivery income information on your delivery dashboard or if you receive one your Form 1099-NEC or in some cases your Form 1099-K.

Americas 1 tax preparation provider. The 153 self employed SE Tax is to pay both the employer part and employee part of Social Security and Medicare. The most important box on this form that youll need to use is Box 7 Non-employee Compensation.

The tax forms you get as a Postmates driver. So lets talk about 1099s today. Since taxes arent withheld from your Postmates income its possible you need to pay taxes quarterly.

Self-Employed defined as a return with a Schedule CC-EZ tax form. How to Get 1099 from Postmates. By linking your Uber Eats account your Postmates delivery account should migrate with you and be displayed in-app on your Uber Profile app.

Its the end of January. Typically you should receive your 1099 form before January 31 2021. As you may already know youll need a 1099-MISC form to do that.

As a Postmates independent contractor you are responsible for keeping track of your earnings and accurately reporting them in tax filings. You can change auto-renew settings in the Unlimited section of your Postmates app. Postmates tax form online Saturday March 19 2022 Edit.

As a Postmates delivery driver youll receive a 1099 form. Its pretty generous so if you drive upwards of 5000 miles per year for work and dont have a gas-inefficient car then youll probably get a larger. It will look something like this.

5 off your subtotal applied as a discount to the Service Fee. Not including taxes and fees. Deleted the app because PM is such trash.

Savings based on the Delivery Fee savings for orders placed over last member cycle excluding the cost of the membership. Here is the link youll need to request a 1099 from Postmates. IRA Tax Forms for All Types of Less - Used Tax Forms.

Dont let your taxes become a hassle. This means that if you work for Postmates you have to track your own taxes. With Postmates Unlimited you get free delivery with no blitz pricing or small cart feesever.

You are starting to get your 1099 forms from Grubhub Doordash Postmates and Uber Eats. Its tax time isnt it. Ad Free software fills out tax forms IRS free file program participant.

IRS Tax Forms For A Postmates Independent Contractor. Still have not received absolutely anything from Postmates. How To Get Postmates Tax 1099 Forms Youtube Postmates Taxes The Complete Guide Net Pay Advance The Ultimate Guide To Taxes For Postmates Stride Blog Postmates 1099 Tax Filing The Complete Guide.

Youll need to file Forms Schedule C and Schedule SE with Form 1040. Independent contractors are generally considered self-employed and report profits and losses on form 1040 Schedule C. Ad Every Tax Situation Every Form - No Matter How Complicated We Have You Covered.

Before I go any further let me make this clear. I can no longer go online in my Postmates Fleet app. 1099 forms are sent to freelancers or contractors by the person or company that paid them.

Getting the form is the easy part. I dread having to call them and ask what is up with my missing tax form. The standard mileage rate for 2017 is 535 cents per mile and its calculated to include the average cost of gas car payments car insurance maintenance and other vehicle expenses.

A 1099 form is an information return that shows how much you were paid from a business or client that was not your employer. Your earnings exceed 600 in a year. Like we said Postmates will send a physical form to your home address if your earnings exceed 600.

Form 1099 is actually a collection of forms that report non-wage income including self-employment income to the IRS. Postmates will send you this form if you made over 600 in a year. Postmates drivers for instance will ultimately receive their forms from Uber since Postmates was.

Last year these fools sent me a corrected 1099 like a week before April 15th. Unlimited free deliveryonly for Unlimited members. This is not meant to be a talk about taxes.

As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. File your taxes stress-free online with TaxAct. According to Postmates if you dont meet this requirement you wont receive a 1099-MISC.

1 online tax filing solution for self-employed. Self Employment tax Scheduled SE is automatically generated if a person has 400 or more of net profit from self-employment. Postmates has joined Uber Eats which means customers and delivery requests have switched to the Uber app as of June 7 2021.

If you earned more than 600 youll receive a 1099-NEC form. Postmates will send you a 1099-NEC form to report income you made working with the company. In this Video I try my best to explain Postmates taxes.

Ad Filing your taxes just became easier. Postmates will send you this form if you made over 600 in a year. I do 3 other apps and have received all of their 1099s.

The fast easy and 100 accurate way to file taxes online. Read on for more details. Try it free with a 7-day free trial cancel anytime.

The best way to figure out if you owe quarterly taxes is to fill out Form 1040-ES or use an online tax calculator to estimate how much income youll have this year and how much youll owe in taxes. Read on for more details. From how to pay your postmates taaxes to what write offs you can claim with postmates.

While Stride operates separately from Postmates I can tell you that Postmates will only prepare a 1099-MISC for you if. There are many IRS 1099 forms but our guide will only review the most relevant ones for your Postmates taxes. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

You can make many deductions through your work effectively reducing your taxes.

Postmates 1099 Taxes The Last Guide You Ll Ever Need

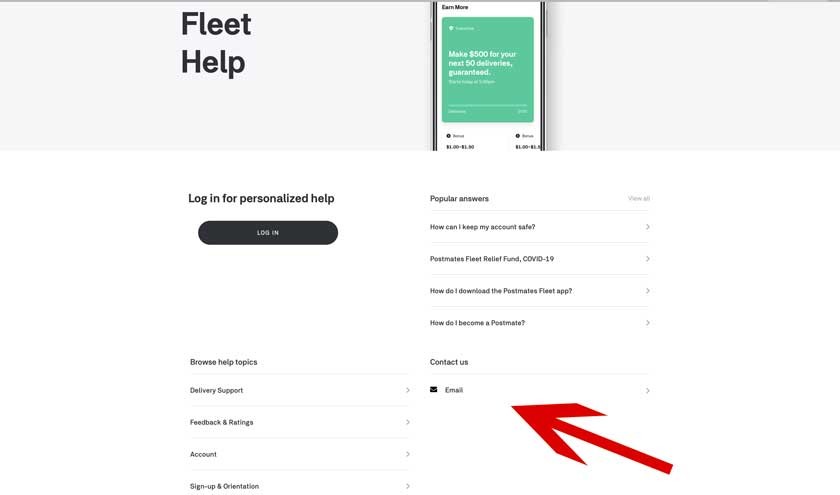

Postmates Customer Service 3 Ways To Contact Postmates Support

Postmates Customer Service 3 Ways To Contact Postmates Support

The Ultimate Guide To Taxes For Postmates Stride Blog

.png)

Postmates 1099 Taxes The Last Guide You Ll Ever Need

Postmates 1099 Taxes The Last Guide You Ll Ever Need

The Ultimate Guide To Taxes For Postmates Stride Blog

How To Get Your 1099 Form From Postmates

How Do Food Delivery Couriers Pay Taxes Get It Back

The Ultimate Guide To Taxes For Postmates Stride Blog

Postmates Taxes The Complete Guide Net Pay Advance

How To Get Postmates Tax 1099 Forms Youtube

Chipotle Sign Saying Staff Walked Out Goes Viral Plus 22 More Similar Signs From Other Us Businesses Sign Quotes Sayings Return To Work

Postmates Customer Service 3 Ways To Contact Postmates Support

4 Easy Ways To Contact Postmates Driver Customer Support

Filing Independent Contractor Taxes For Food Delivery Drivers Tax Write Offs Tax Help Independent Contractor

How To Get Your 1099 Form From Postmates

Postmates Taxes 101 Filing Postmates Taxes For The End Of The Year Youtube